Transaction Levy Surcharges in Ontario: What Lawyers and Their Bookkeepers Need to Know

- Sep 1, 2025

- 3 min read

If you run a law firm in Ontario or handle the bookkeeping for one, you should be aware of the transaction levy surcharge. These surcharges are a key part of the LSO’S By‑Law 6, which details the professional liability insurance requirements and associated fees for Ontario lawyers and law firms. Here is a breakdown of what they are, when they’re due, and how to be compliant with LAWPRO.

What Are Transaction Levy Surcharges?

Transaction levy surcharges are “pass-through” expenses. Similar to how HST is collected on behalf of the government, these surcharges are collected from clients on certain types of files and then remitted in full to LAWPRO.

They don’t generate revenue or profit for the firm, nor do they provide any direct benefit. Instead, they are a compliance requirement tied to Ontario’s professional liability insurance program.

Once collected, the total amount is reported and remitted to LAWPRO every quarter.

How Much Are Transaction Levy Surcharges?

In Ontario, lawyers must pay surcharges on certain files. At the time of this article the amounts were:

Real Estate Transactions – $65 per deal

Civil Litigation Matters – $100 per proceeding

While these surcharges function as part of the lawyer’s insurance obligations, they can be billed back to clients as a disbursement. Because they’re treated as disbursements, HST applies as follows:

Real Estate Levy: $65 + $8.45 HST = $73.45

Civil Litigation Levy: $100 + $13 HST = $113

Recording Levies in Legal Bookkeeping Software

A common mistake law firms make is misrecording transaction levies in their bookkeeping software, especially when entries are left to staff without proper training. The process, however, is straightforward. Most legal practice management systems provide a dedicated module for levies. To avoid errors, always use the levy option in your practice management system rather than entering it as a general disbursement. This ensures the levy is recorded in the correct category and, because the module is designed for this purpose, it also simplifies filing with LAWPRO.

The following steps show how to post transaction levies in three different software platforms.

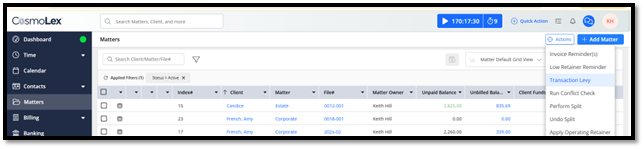

In CosmoLex, go to:

Matters --> Actions -->Transaction Levy

In PCLaw, go to:

Data Entry -->Transaction Levy…

In PageLightPrime, go to:

Settings -->Practice Area

Who Has to File and Exemptions

Not all Ontario lawyers need to worry about transaction levy surcharges. These levies only apply to lawyers who handle real estate transactions or civil litigation matters. Suppose a lawyer doesn’t practice in either of these areas during a given year. In that case, they can avoid quarterly filings altogether by submitting an annual exemption form to LAWPRO by April 30 of the respective year.

The exemption exists to eliminate unnecessary filings for lawyers whose work never triggers the levy. Once submitted, it frees the firm from quarterly reporting for the rest of the year—saving time, effort, and ultimately money.

Filing Deadlines

Quarterly levy filing and payments are due by the last day of the month following the quarter-end.

Q1 (Jan–Mar) due April 30

Q2 (Apr–Jun) due July 31

Q3 (Jul–Sep) due October 31

Q4 (Oct–Dec) due January 31

All submissions, including exemptions, can be filed online at my.lawpro.ca.

Pro Tips for Legal Bookkeepers

If you’re the law firm’s bookkeeper, stay ahead:

Be proactive – Don’t wait for the lawyer to ask. If quarter-end is near and levies haven’t been entered, give a gentle reminder to whoever is responsible for posting them.

Use the software correctly – If available, always record levies through the dedicated module in your practice management system.

Closing

Transaction levy surcharges are a small but important part of Ontario law firm bookkeeping. Whether you’re a lawyer or a legal bookkeeper, keeping track of deadlines, exemptions, and proper recording is key to staying compliant.

Need Help?

LAWPRO provides direct support:

Phone: 1-800-410-1013

Email: service@lawpro.ca

Guides & FAQs: How to file transaction levies or exemptions

###

Keith Hill Jr. is the President of Bookkeeping Matters Inc. (BMI), a trusted provider of legal bookkeeping services for over a decade, serving law firms across Ontario and beyond. Drawing on his experience as a former Legal Accounting professor, Keith has also positioned Bookkeeping Matters as a leading source for online legal bookkeeping education. To learn more about the Legal Bookkeeping Training Program, visit: https://www.bookkeepingmatters.ca/learn-legal-accounting

At Bookkeeping Matters, we are dedicated to helping law firms optimize their financial operations and to preparing future legal bookkeepers with the knowledge they need to excel.

Contact: info@bookkeepingmatters.ca | 1-800-893-2820 | www.BookkeepingMatters.ca

©2025 Bookkeeping Matters Inc. All rights reserved. Reproduction with credit is permitted.

Comments